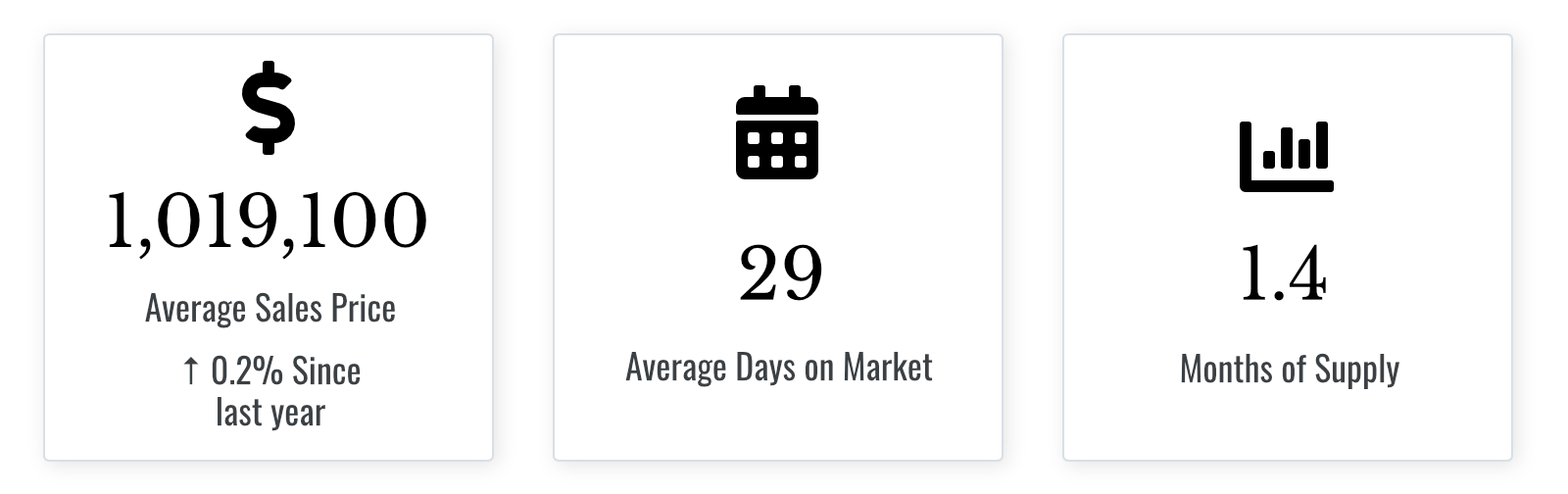

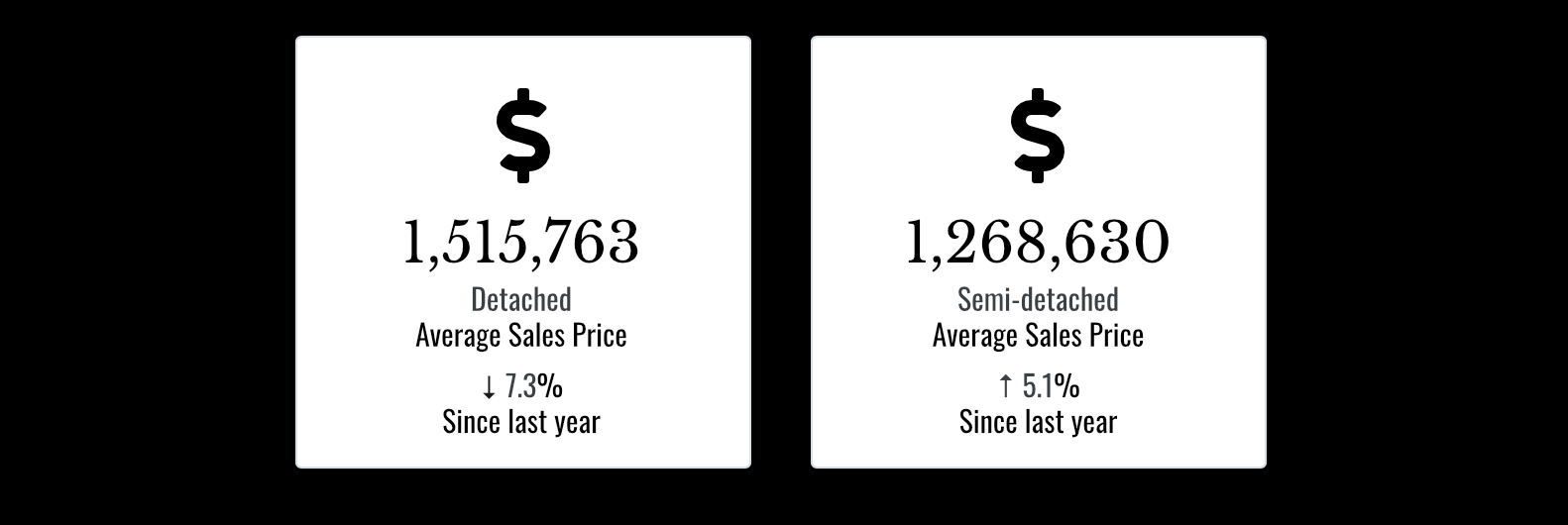

Market conditions remained much more balanced in July 2022 compared to a year earlier. As buyers continued to benefit from more choice, the annual rate of price growth has moderated. Less expensive home types, including condo apartments, experienced stronger rates of price growth as more buyers turned to these segments to help mitigate the impact of higher borrowing costs.

The Greater Toronto Area (GTA) population continues to grow and tight labour market conditions will drive this growth moving forward. Despite more balanced market conditions resulting from rapidly increasing mortgage rates, policymakers must continue to take action to boost housing supply to account for long-term population growth. With savings high and the unemployment rate still low, home buyers will eventually account for higher borrowing costs.

"Many GTA households intend on purchasing a home in the future, but there is currently uncertainty about where the market is headed. Policymakers could help allay some of this uncertainty. As higher borrowing costs impact housing markets, TRREB maintains that the OSFI mortgage stress test should be reviewed in the current environment," said TRREB CEO John DiMichele.

"With significant increases to lending rates in a short period, there has been a shift in consumer sentiment, not market fundamentals. The federal government has a responsibility to not only maintain confidence in the financial system, but to instill confidence in homeowners that they will be able to stay in their homes despite rising mortgage costs. Longer mortgage amortization periods of up to 40 years on renewals and switches should be explored," said TRREB President Kevin Crigger.

"With significant increases to lending rates in a short period, there has been a shift in consumer sentiment, not market fundamentals. The federal government has a responsibility to not only maintain confidence in the financial system, but to instill confidence in homeowners that they will be able to stay in their homes despite rising mortgage costs. Longer mortgage amortization periods of up to 40 years on renewals and switches should be explored," said TRREB President Kevin Crigger.