This fall, the big story is interest rates. The Bank of Canada finally gave buyers a bit of breathing room with a rate cut, and it’s like someone opened a window in a stuffy room. People who had written off homeownership are peeking back in, wondering if now might actually be their chance.

Sales ticked up in September compared to last year, and that’s not nothing. More buyers are stepping into the market, lured by slightly more affordable monthly payments. But with all that choice out there, they’re also negotiating prices down. It’s a buyer’s market in many ways, or at least a buyer’s moment, and sellers are having to adjust their expectations accordingly.

Here’s another interesting twist: while sales rose from August, new listings dipped. That might not sound like headline news, but it hints at a subtle shift in the balance of power. If fewer homes hit the market while more buyers start to circle, competition could heat up again in certain price ranges.

Prices overall are still lower than they were this time last year. For anyone hoping for a screaming hot seller’s market, that might sting. But for those who felt priced out before, it’s a welcome reality check. Lower prices plus cheaper borrowing costs could mean the difference between “someday” and “right now” for a lot of first-time buyers.

The truth is, we’re in a transitional moment. The market isn’t booming, but it’s not flatlining either. It’s shifting, slowly and maybe awkwardly, but shifting all the same. And those shifts are often where opportunity hides.

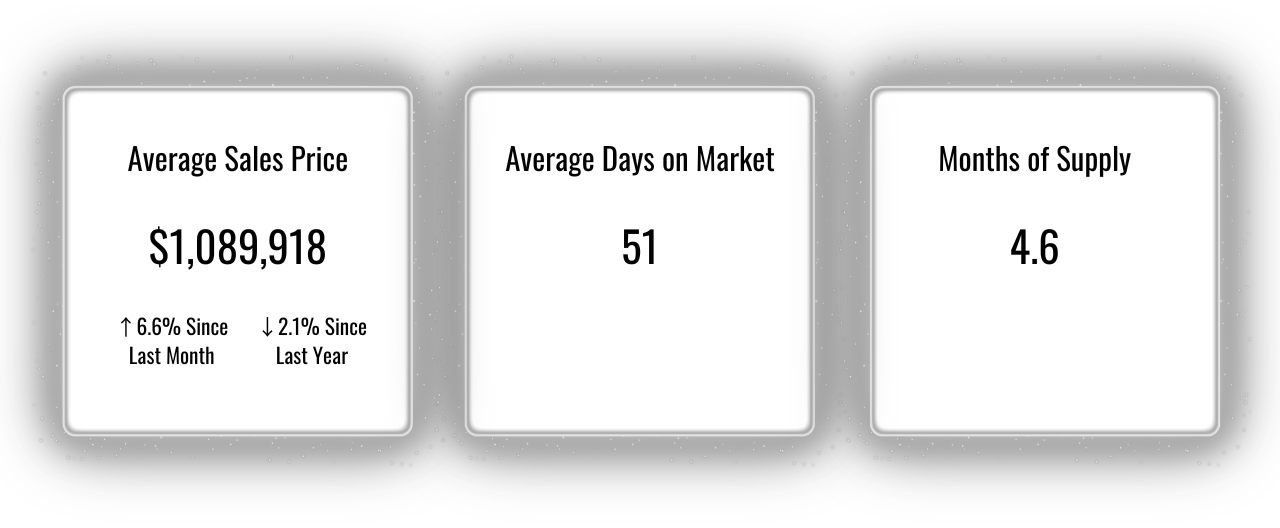

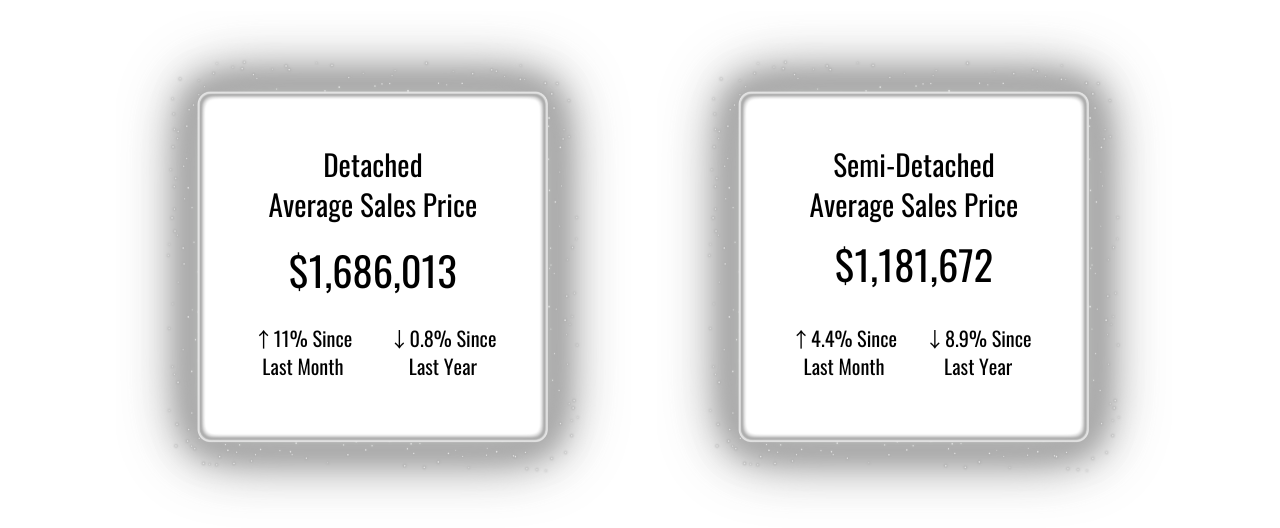

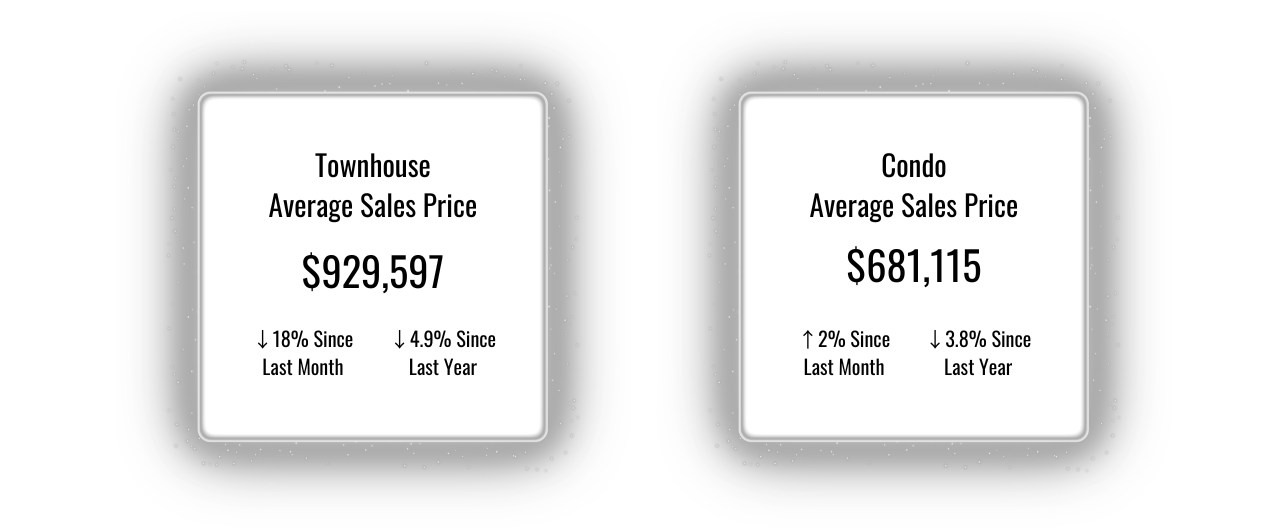

Here are the most recent Toronto numbers…